OUR ASSET MANAGEMENT STRATEGIES

– THE MIXTURE IS THE ESSCENCE

We have multiple option -all for your own profit.

Within the scope of our asset management, the following financial instruments are available:

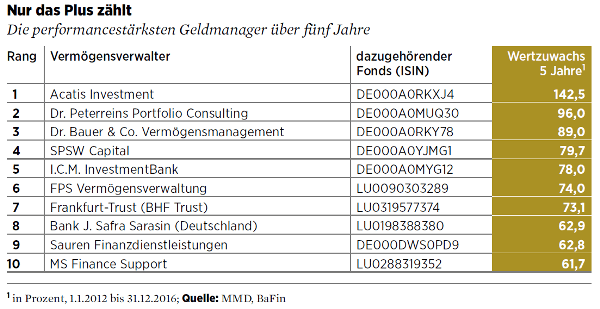

ICM ONE OF THE TOP 10 BEST PERFORMING

ASSET MANAGERS OVER A FIVE-YEAR PERIOD

Source: MMD, BaFin, 01.01.2012 bis 31.12.2016

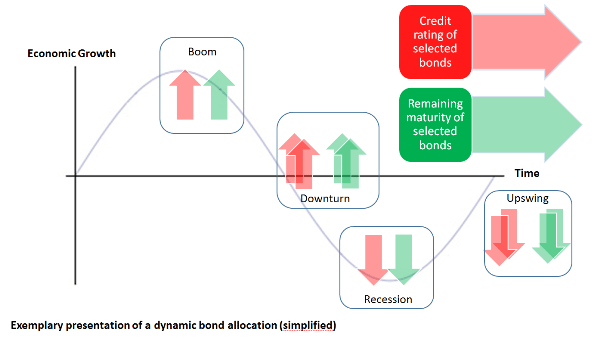

ACTIVE BOND MANAGEMENT

We offer you an active management – also for fixed-interest bonds, since long gone are the times when only a simple “security bond” was required for a custody account.

BRANCH AND LÄNDER EQUITY ALLOCATIONS WITH ETFS

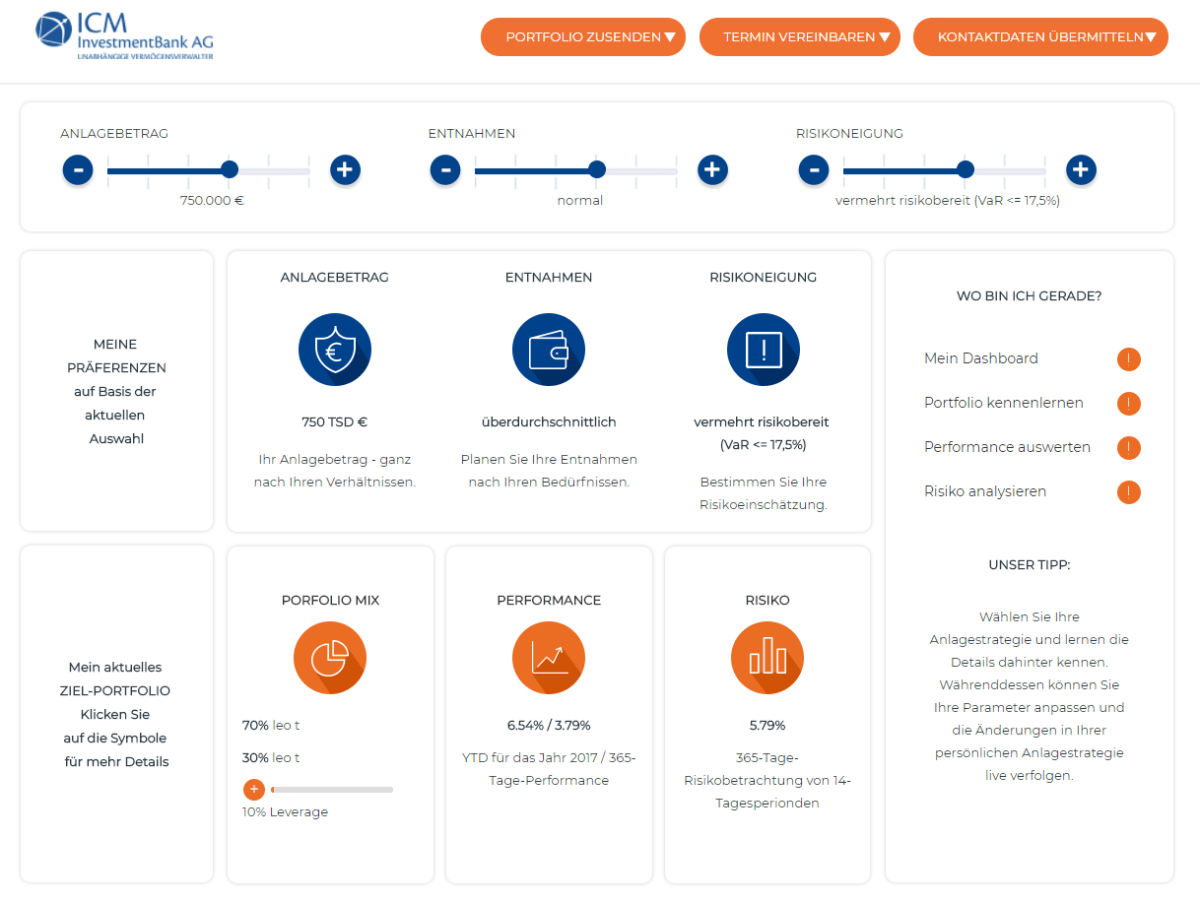

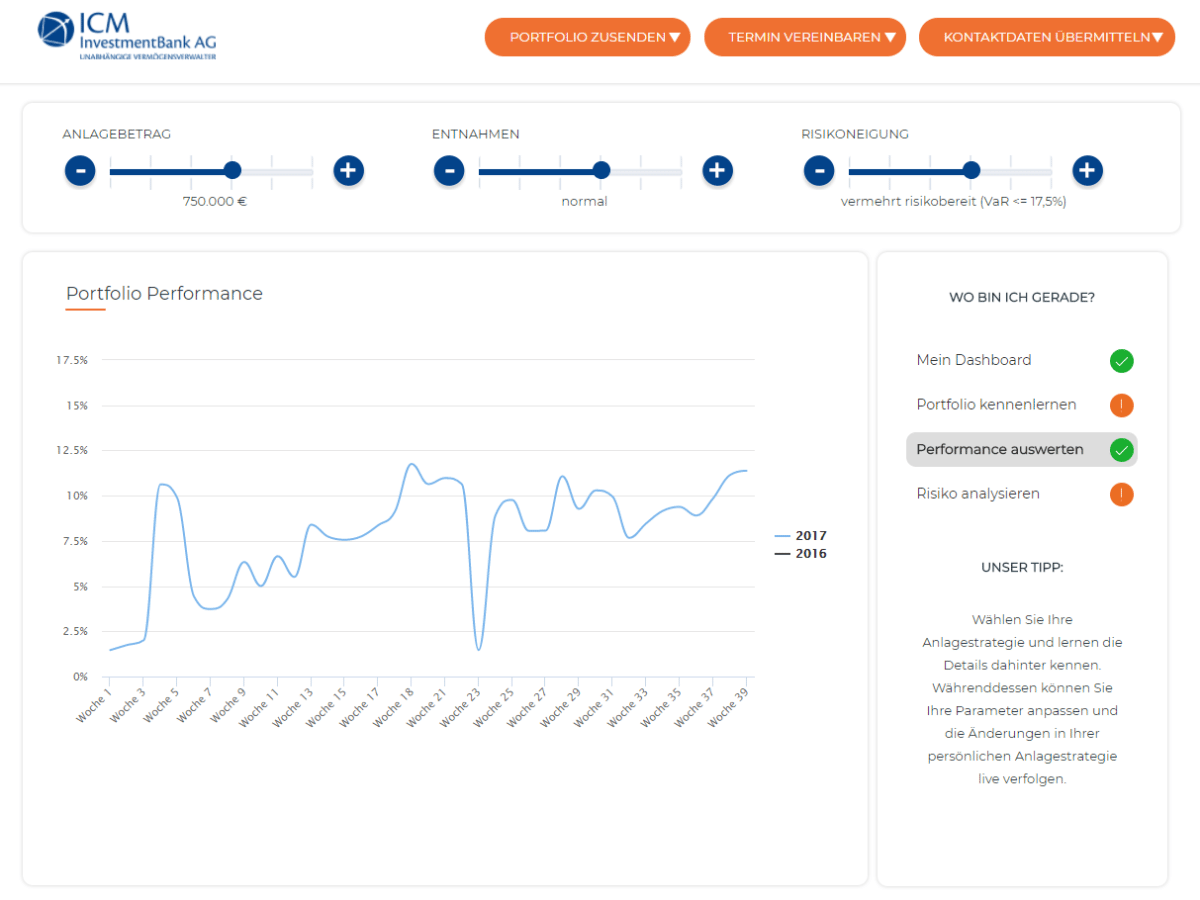

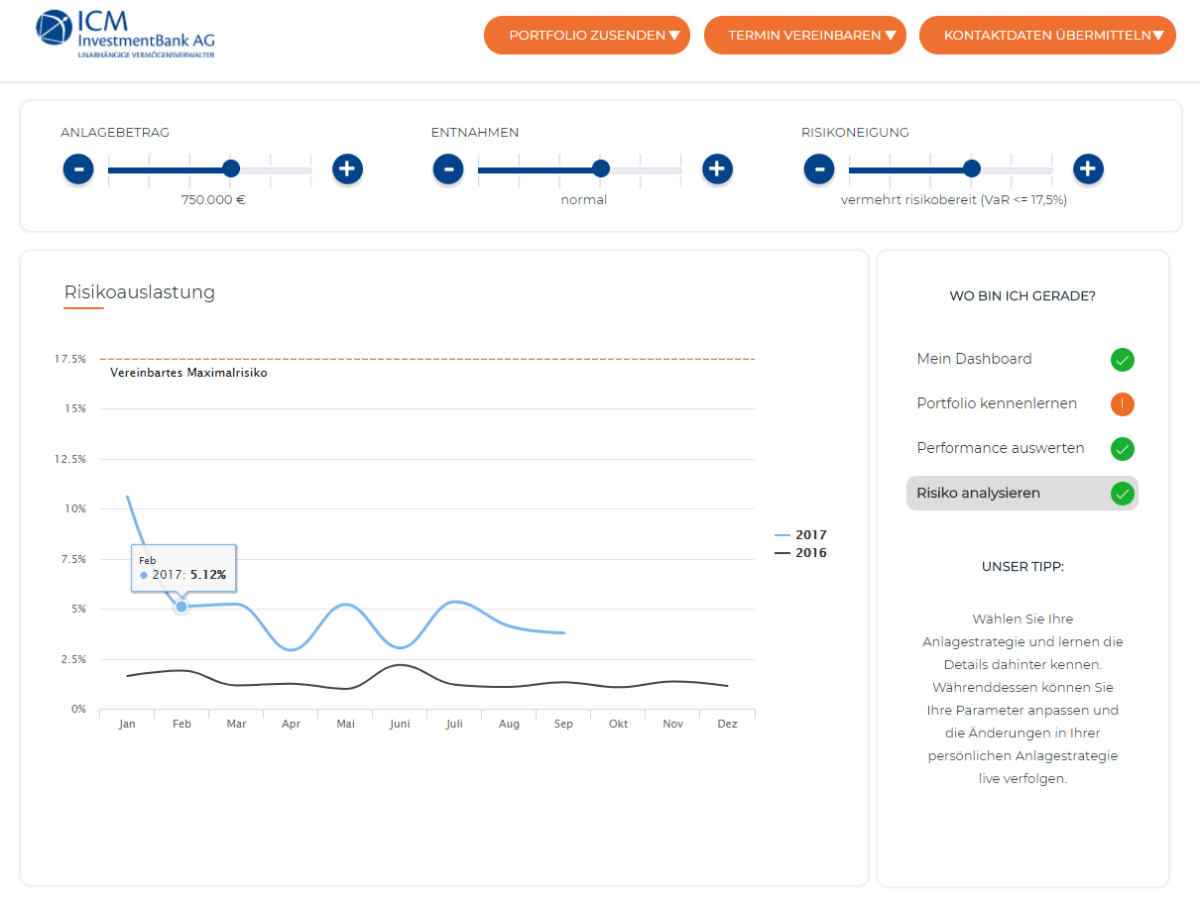

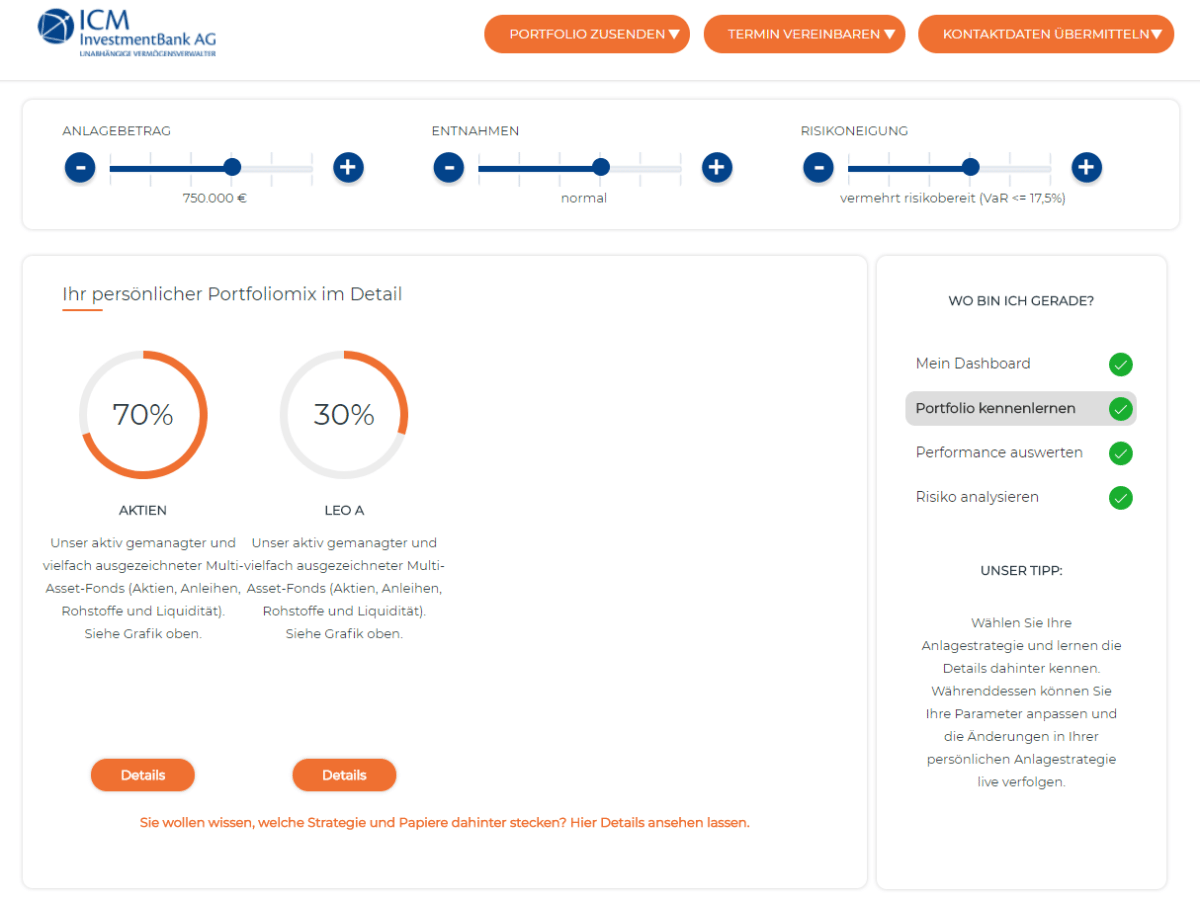

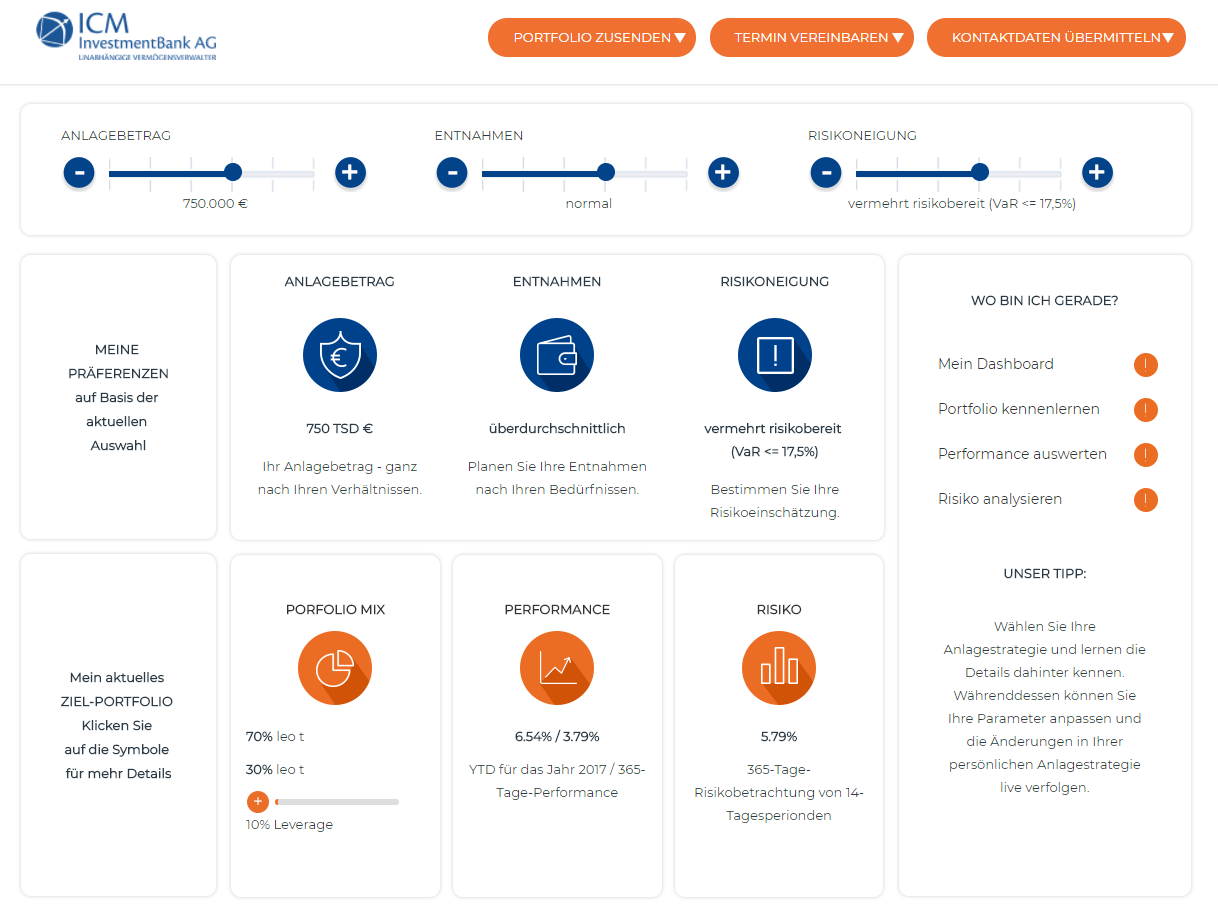

*To your asset strategy within 3 minutes

OUR ASSET MANAGING INVESTMENT FUND

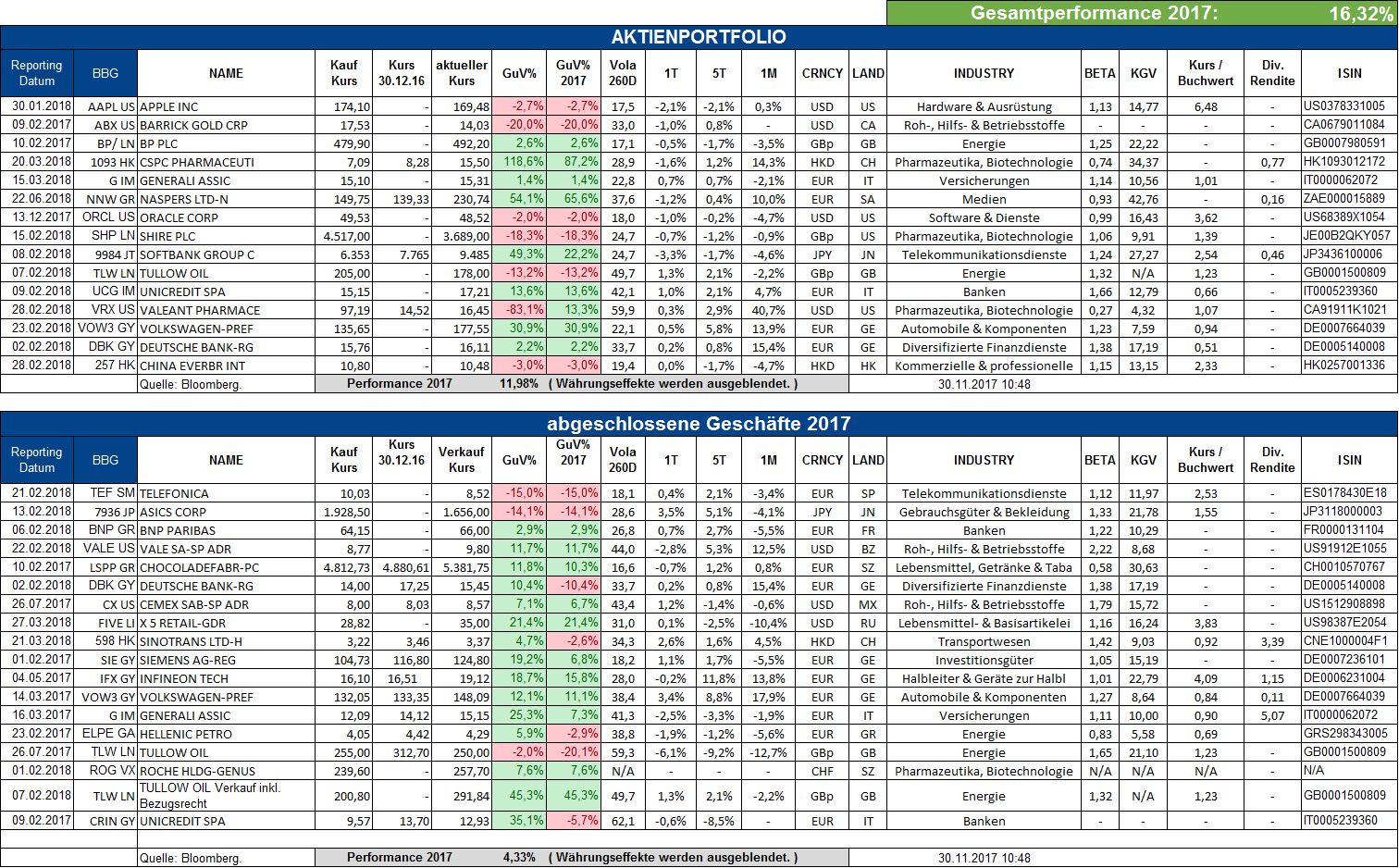

All our asset managing investment funds are actively managed by us – with distinct strategies. Buy and hold is the rule, since the structure between and within the different asset classes is permanently adapted to the market situations and assessments.

Successful portfolios are characterized by diversification, because the risks remain manageable. Therefore, each of our portfolios includes at least 10 securities. This wide variety is reflected in how we manage our fund:

PORTFOLIOS WITH SHARES AND STOCK OPTIONS

*To your asset strategy within 3 minutes

MANAGEMENT OF LISTED

DERIVATIVE POSITIONS (ALTERNATIVES)

What do ICM alternatives offer you?

Access to markets that were difficult to access for customers

Multidirectional long – short strategies in rising and falling markets.

Illustration of own prognosis in complex derivative strategies

Selection of asymmetric profit-loss scenarios with positive profit-loss relationship

Ex ante definition of maximum loss

Direct investment of listed derivative positions (no OTC, no certificates, no CFDs, no other instruments issued by third parties)