DO YOU BELIEVE IN ETFs AND PASSIVE INVESTMENT STRATEGIES?

We too. But not constantly and not everywhere. As ETF-based strategies cover only 50% of bonds, for example. You should make better use of this opportunity. You want to know how? Click here for the investment process on the ecample of bonds >>

FOUNDATIONS

Private and public foundations are among our customers.

How do you act as a foundation committee with regard to the tension that exists between stock and profit orientation? How do you manage your foundation in relation to the selection of investment products, and how do you deal with investment risks? Which internal foundation competencies make the decisions, and which supervisory bodies monitor the decisions? Is external expertise used to safeguard independence and improve quality?

Foundations hardly have the opportunity to invest in their own active asset management. The associated costs in relation to the achievable yield are too high. In addition, internal solutions lack the diversification of usable expertise to achieve independent investment strategies. Most foundations base their investment decisions on three aspects:

• the goal of capital preservation

• a definition of asset classes

• a definition of risk parameters

Most foundations consider the goal of capital preservation as the most important thing.

In addition to the Group-independent asset management approach, ICM also attaches importance internally to independent and departmental investment committees to guarantee the quality of service. In principle, meeting minutes of the investment committees provide the highest level of pre- and post-trade transparency and thus form the basis for bringing together the investment opportunities developed at the foundation level. As a result, the foundation committee benefits from optimally suitable reporting for efficient compliance with the regulatory body functions at the foundation level.

• Targeted use of the potential for the realization of the Foundation’s purposes

• High portfolio diversification through five independent investment committees

• Specification of foundation requirements: target – asset classes – risk parameters

• Consideration of social, ecological or ethical criteria in the sense of the purpose of the foundation

• Improvement opportunities, especially with regard to the control and monitoring mechanisms

• Compliance with the responsibility with regard to the legal obligations of the foundation

While at the typical interest rates of the 1990s, the preservation of the foundation’s assets could still be realized by investing in fixed-income securities, such a conservative investment strategy was no longer possible since the turn of the millennium. Despite this realization, the majority of foundations have so far not rethought their investment behavior. With their proven, security-focused investment strategies, many foundations no longer manage to reconcile the goals of security, wealth preservation and sufficient income in the interest of all parties. In the current market situation, the preservation of the fund capital can only be guaranteed through active portfolio management. A failure to increase assets, for example on non-interest-bearing accounts, is a possible violation of the obligation to maintain the capital value.

Administer a strategic portfolio management that defines and complies with an investment strategy – These two tools are appropriate measures to actively and persistently engage with your investment and, in particular, include measures such as liquidity management payout ratios to optimize the investment.

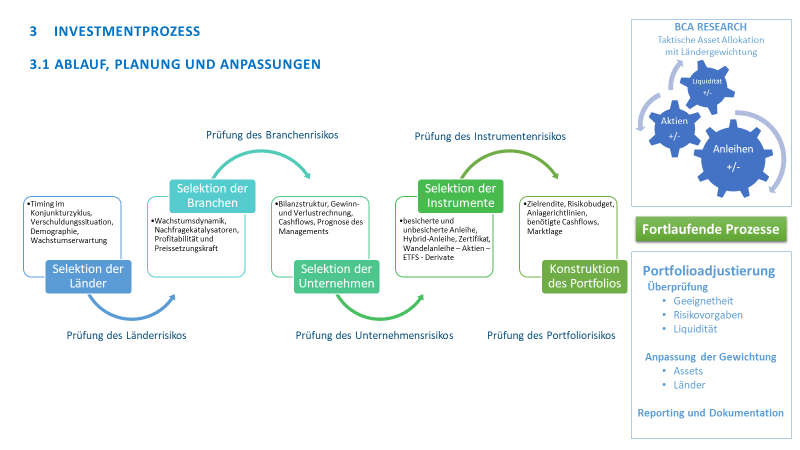

We pursue an opportunistic investment approach. Only liquid financial instruments are selected in an international orientation. Continuous quality assurance by investment committees geared to the individual asset class ensures the logical composition of the strategic positions.

The dynamic adjustment of weightings in sectors, such as equities to bonds and various economic areas, results in a consistently adjusted and risk-adjusted portfolio. Thus, the goal definitions are not only adhered to at the time of entering into an active risk management, but also ensure compliance with agreed parameters in the subsequent period.

ICM InvestmentBank focuses on corporate bonds as a base investment in fulfilling the foundation’s requirements. In Germany, this offer defines a certain unique position, as the foundation receives access to bonds from as little as EUR 250,000, which are otherwise only accessible to institutional clients due to the minimum denomination. Our tailor-made bond portfolios, stringent to the foundation profile, can only be compared with millions of portfolios of large houses in terms of their spread.

For risk control, the investment process procedures and the portfolio parameters are constantly reconciled in their parameters. Both limits monitoring in individual securities, as well as granular control measures in their dependence and impact are evaluated and compared with the targets. All portfolio positions are updated in terms of new qualitative (e.g., corporate numbers and messages) and quantitative (e.g., liquidity changes, accumulation behavior) information.

When you hire an institution to manage its assets, not only are the strategic objectives important, but also how the position relates to other “strategic asset management positions”. Our dynamically adjusted risk management also takes into account these quantitative risks. We attach great importance to allocating well-curated and diversified positions to the foundation portfolio, which are not held by disproportionately large groups (accumulation risk). With our strategy approach, you will not get a “everyone’s” portfolio, but a real added value. The continuous research work looking for “good risks” is appreciated by both our institutional and our private investors.

INVESTMENT PROCESS, CUSTOMER INTEREST CREATIONS, REMUNERATION INCENTIVES, BENEFITS AND INVESTMENT PROTECTION

The ICM has arrangements to avoid any conflicts of interest, which are reviewed annually by the regulator and an accounting firm for suitability. In addition, the three-strong compliance department ensures compliance with organizational guidelines.

Due to the advanced structure of the investment committees, the multi-user principle is always in place, so that at any time trading decisions are made exclusively in the interests of the client..

In principle, the compensation structure of the ICM complies with the legal requirements of the Institutsvergütungsverordnung according to Directive 2013/36 / EU of the European Parliament and of the Council of 26 June 2013. In particular, we attach great importance to the full implementation of the legal requirements under MIFID II.

As part of the implementation of MIFID II on 03.01.2018, no donations will be approved by third parties. Neither monetary nor non-monetary benefits are part of our service. All grants received in 2017 from the administration of special funds are summarized in the Grant List.

ICM InvestmentBank AG is a member of the EDW. All assets under management are maintained at the name and on behalf of the client at the relevant account-holding institution. (DAB BNP Paribas) The renowned banking institutions are subject to the security fund of the banks, this applies to liquidity in the customer account. All securities held by the Custodian Bank are not subject to counterparty default risk under the Trust Deed.